In 2015, OPB’s Investments team continued to generate stable investment returns in an increasingly challenging environment. The team successfully managed through turbulent economic conditions by advancing its in-house asset management and building relationships with like-minded investment partners.

In the following interview, Jill Pepall, OPB’s Executive Vice-President & Chief Investment Officer (EVP & CIO), offers her outlook for the coming year. More specifically, she talks about the benefits of asset pooling and how OPB’s investment strategies position the Plan to take advantage of the expected continuation of market volatility in 2016.

In 2015, you beat your benchmark rate of return. To what do you attribute this success?

OPB’s success in 2015 can be attributed primarily to our timely Tactical Asset Allocation (TAA) decisions, the strong performance of our Real Estate portfolio, and the flexibility to leverage in-house expertise to take advantage of changing market conditions across all asset classes.

Why would an investor want to look at both absolute and relative returns when describing the success of an investment? Looking back on 2015, why is this especially relevant?

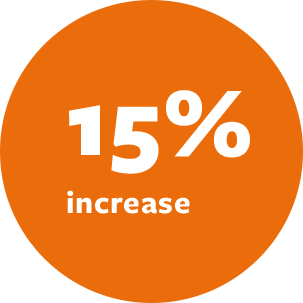

Monitoring both absolute and relative returns is important because it provides two different perspectives: assessing market conditions and evaluating the individual manager’s ability. Absolute return (i.e., the actual return) is driven, in large part, by the financial markets. For example, during stock market rallies, absolute return will tend to be higher than when equity markets are declining, and vice versa. Relative return (i.e., OPB’s actual return (6.14% in 2015) compared to the Strategic Asset Allocation (SAA) benchmark return of 5.37% for the same period) tells us if Management is taking advantage of the market conditions, and speaks to the value-add that is generated regardless of whether financial markets are up or down. This difference is important in a year like 2015, when markets were challenging and volatility was high. In 2015, major global equity markets were weak and interest rates remained low. Although this impacted the absolute rate of return, on a relative basis, OPB was able to take advantage of the market volatility, and we added value by exceeding the benchmark return by 77 basis points.

In 2017, OPB intends to implement the recently announced Government of Ontario asset pooling initiative with the Workplace Safety and Insurance Board (WSIB). How can larger asset pools benefit the PSPP and its members?

The objective of the asset pooling initiative is to create and operationalize a new world-class investment manager, the Investment Management Corporation of Ontario (IMCO), that will provide fiduciary, cost-effective investment expertise to the PSPP and WSIB initially, as well as to other broader public sector (BPS) pension plans and entities in Ontario that wish to participate. The larger scale that will be achieved by pooling BPS assets will permit access to larger investment opportunities in a wider array of asset classes. Other expected benefits from asset pooling include:

- higher risk-adjusted investment returns;

- lower investment management fees and expense ratios through an optimal combination of internal investment management and a larger asset base with external managers; and

- enhanced research and risk management supported by leading-edge information technology and expertise.

What’s important to note for the PSPP and its members is that ownership of the assets and pension obligations of the Plan are not being transferred to IMCO. Both will remain with OPB, as will OPB’s investment philosophies and policies as well as its asset allocation strategies. This will preserve the important interrelationship between the Plan’s assets and liabilities. What will change are the management of the Plan’s assets and the expectation of higher returns and lower relative investment costs in the future. For more information about asset pooling, click here.

Why is working with trusted partners such an integral part of OPB’s investment strategy?

In order to achieve strong results, building relationships with like-minded partners is critical. This approach helps OPB gain access to high-quality investment opportunities; enables us to leverage our partners’ expertise in particular industry segments or geographic areas, leading to more informed and ultimately better investment decisions; and encourages the building of long-term, mutually beneficial relationships through which we are able to gain access to research on industry developments, market intelligence and investment trends.

OPB looks for like-minded partners who share a common approach and philosophy toward investing and understand the responsibility of being a fiduciary. This helps ensure we share a similar strategy for value creation and improves the alignment of interests with our partners.

Ultimately, OPB’s culture is one that values trust, collaboration and accountability, and we look for partners that share similar values.

Why is private markets an important part of OPB’s diversified investment strategy? Why are you focused on growing it?

Given OPB’s long-term investment horizon, investing in more private market assets is a natural way to enhance investment returns while adding diversification away from the more volatile public markets. Real assets (infrastructure and real estate) help protect the Plan from volatility because a larger proportion of their returns are in the form of ongoing stable cash flows. Private equity offers attractive risk-adjusted returns and allows improved diversification by asset type, industry and geography. Although fees can be higher for some private market investments, these are offset by higher net returns. In addition, privately negotiated transactions may offer better rights, protections and governance than are available in the public market.

The 2011 SAA first introduced Infrastructure and Private Equity to OPB’s portfolio and increased the allocation to Real Estate. Since then, our 2014 triennial SAA review increased allocations for Infrastructure to 10% and Private Equity to 5%, and confirmed Real Estate’s allocation as 23% (net of financing).

How does OPB incorporate Environmental, Social and Governance (ESG) considerations into its investments?

OPB believes that supporting ESG initiatives will improve corporate transparency and disclosure practices; enable long-term investors, such as OPB, to better evaluate investment return–risk trade-offs; and ultimately support OPB’s efforts to achieve the Plan's objectives. There is strong evidence that improved ESG engagement can have a positive impact on investment portfolio performance. Companies that follow the principles of good governance have less risk and generate higher long-term value for their shareholders. Supporting initiatives that promote corporate transparency allow for improved information flow, which increases the ability to better assess a company’s risks and make a more informed investment decision.

OPB adopts a pragmatic approach to integrating ESG considerations into its investment policies and procedures. Some examples of actions taken in 2015 include:

- Collective engagement: OPB became a signatory to the United Nations–supported Principles of Responsible Investing, an important forum for collective engagement with companies and other enterprises where OPB believes improvement in disclosure practices and other ESG activities is necessary; and

- Proxy voting: We developed our own proxy voting strategy, which incorporates ESG considerations, among other relevant factors, into our voting of publicly traded securities. OPB views proxy voting as an important tool to encourage companies and other enterprises to provide adequate disclosure to shareholders relating to ESG factors, policies and initiatives.

It is also important that factors such as ESG are incorporated in a manner that supports OPB’s overriding fiduciary responsibility to act in the best interests of Plan beneficiaries and for the long-term sustainability of the Plan.

What other important goals or achievements did the Investments team deliver in 2015?

OPB’s core investment goals for 2015 were:

- optimizing the implementation of our SAA;

- continuing to build on in-house expertise and management of assets; and

- enhancing our investment risk assessment and analysis as well as advancing our contribution to asset management.

Optimizing the implementation of our SAA

The Investments team is executing on its multi-year plan of moving to an investment portfolio with a greater exposure to private markets. In 2015, all three private market asset classes exceeded their phase-in target weights. More impressively, during the building and deployment phase of the newer infrastructure and private equity asset classes, OPB has been able to invest directly in mature funds and in assets, avoiding paying fees to managers before they have actually made investments – a situation that can result in lower returns in the early years of a fund’s existence.

Continuing to build on in-house expertise and management of assets

OPB enjoyed success in 2015, selectively bringing the management of some of our public markets assets in-house from external managers (Internalization Program). The Internalization Program provides value-added portfolio management, while lowering costs and providing greater control and transparency. As part of the program, OPB performs a rigorous cost/benefit analysis and ensures back-office capabilities are in place prior to launching an internal mandate. Specifically, OPB launched a liquidity-based money market mandate designed to facilitate smaller funding requirements and a market-neutral portable alpha mandate designed to enhance fixed income returns with similar or lower risk.

Enhancing our investment risk assessment and analysis as well as advancing our contribution to asset management

As OPB moved forward with the Internalization Program, it became increasingly important to advance and strengthen our investment risk assessment and reporting capabilities. Significant strides were made in 2015 with our in-house risk monitoring and measurement processes. Key successes included incorporating private markets investments into the risk analysis and enabling OPB to effectively review the impact of potential investment decisions on the Plan’s risk positions. Another successful enhancement to the in-house risk tool is its ability to assess and manage Surplus at Risk, allowing OPB to measure the impact of portfolio decisions on risk as it relates to the Plan’s liabilities.

In light of ongoing volatility, what is your view/OPB’s perspective on emerging markets? What factors will you be looking at to gauge the success of these investments in future years?

Investing in emerging markets is a long-term strategic decision to benefit from the relative wealth and growth shift from developed to developing economies. Maintaining a significant exposure to these emerging market economies provides a return-enhancing complement to other assets and strategies currently employed by the Plan. Our Emerging Markets portfolio is structured to benefit from various uncorrelated strategies. These range from working with investment managers who have a focus on capital preservation; to structuring complementary investment strategies; to allocating to satellite strategies such as small cap, China A-Shares and local emerging market debt. Since emerging markets tend to be inefficient and volatile, active management can provide the opportunity to exceed the Plan’s benchmark return with lower risk. At the present time, valuations of emerging market assets are relatively cheaper than developed markets and currently provide a good opportunity for the Plan.

What is your investment outlook for 2016?

There are a number of factors currently in place that are contributing to a reduction in global liquidity. After a historically lengthy period of financial easing, the U.S. central banking authority made its first attempt at raising or normalizing its policy interest rates in late 2015, and China continues to spend reserves to manage an orderly decline in its currency exchange rate. A historic collapse in energy prices has led to disarray in global debt capital markets, which were used to finance high-cost energy solutions. As global liquidity has reduced, so has the appetite for risk assets. The effective withdrawal of liquidity has brought about elevated market volatility that will likely remain in place for the foreseeable future. These circumstances, when coupled with relatively expensive valuation levels for equities, make the 2016 investment horizon very challenging – not dissimilar to the latter half of 2015.