2014 annual report

INVESTMENT AND FUNDING HIGHLIGHTS

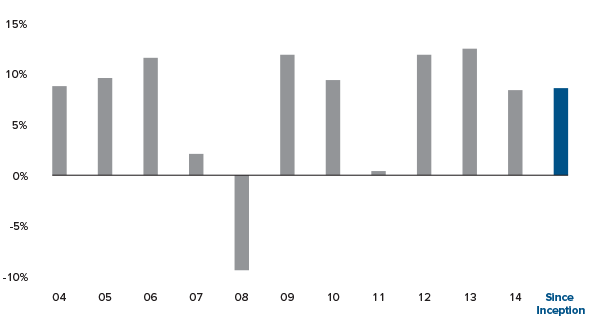

Our Investments team delivered strong returns of 8.4% in 2014, comfortably above the long-term rate of return of 5.95% required to meet our pension obligations. These positive results helped to push the Plan’s funded position to more than 98% – up from 96% at year-end 2013.

Staying ahead of the curve and succeeding in a challenging investment climate requires a forward-thinking approach. With an eye on the future, we continue to shape, shift and strengthen our Investments program. In 2014, for example, we:

- conducted an asset/liability study to assess the “fit” between our assets and liabilities;

- adjusted our Strategic Asset Allocation to reflect the results of the asset/liability study, placing greater emphasis on private markets and long-term public bonds;

- refined our Tactical Asset Allocation strategy, to enhance our ability to adjust the Plan’s risk exposures at various points in the market cycle and take advantage of investment opportunities;

- leveraged new investment information technology systems to generate timely, accurate and actionable information needed to make prudent investment decisions; and

- strengthened our risk management protocols and procedures to keep pace with the growing complexity of OPB’s investment mandate.

We continue to look ahead to keep the Plan sustainable and affordable for future generations.

Total Returns

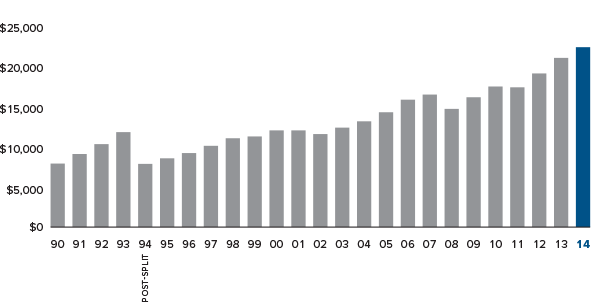

Growth of Plan Assets

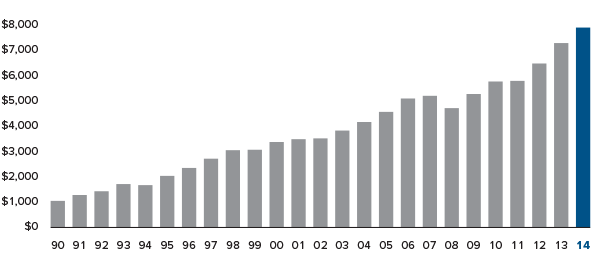

Growth of $1,000 since inception

Net Assets Since Inception

(in millions of dollars)