Table View

Table View

Construction has progressed well on 16 York Street, an OPB and Cadillac Fairview office tower in downtown Toronto (targeted LEED Platinum and WELL certification) with completion scheduled for 2020.

IMCO announced on behalf of OPB, through partnership with Cadillac Fairview, the development of a 1.2 million-square-foot office tower in downtown Toronto, scheduled for occupancy in 2022, that will be the new home of the Ontario Teachers’ Pension Plan (OTPP).

Worked closely with IMCO in the development and approval of its first Responsible Investing (RI) Policy.

IMCO voted on OPB’s behalf at 983 public company meetings, including the support of eight shareholder proposals to enhance disclosure and/or action on climate change.

Our CIO looks at how OPB successfully navigated a challenging year.

Ken Lusk

Chief Investment Officer

We’ve weathered negative conditions before, such as in 2008. Our investment and funding management strategies helped us to recover from that experience, and will continue to do so, positioning us well to protect the pension promise.

How did our investments perform in 2018?

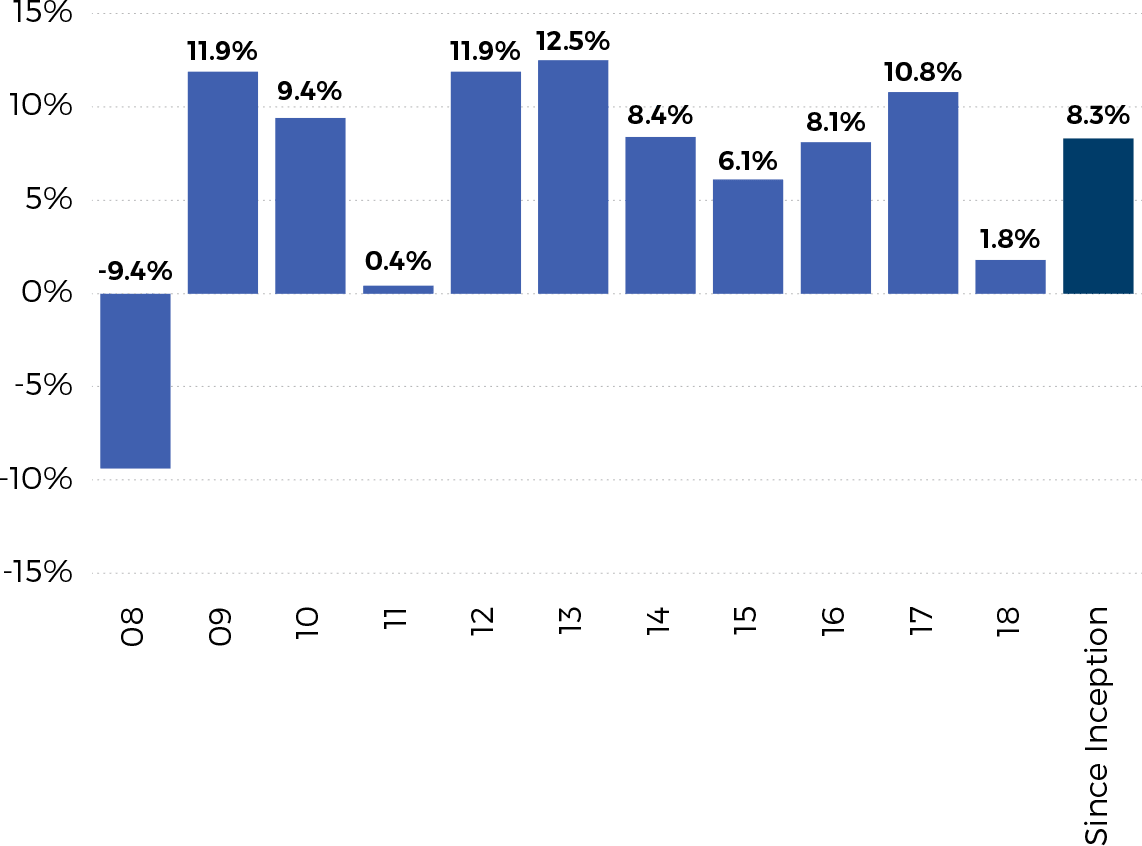

It is in the nature of financial markets to go through challenging periods. In 2018, after several years of strong returns, the challenging investment environment led to a very low investment return of 1.8%. Global equity markets outside the U.S. were down by about 10% in 2018 and, while U.S. equity markets performed better, they still lost about 4.5%.

Naturally, this had a negative impact on the performance of our investment portfolio and those of our peer plans. In 2018, our public equity investments had a negative return of 3.5%.

In contrast to our overall losses on public equities, we had positive performance of 1.9% from our fixed income investments, and our private markets investments delivered a strong overall return of 8.5%. After a difficult start to 2018 due to rising interest rates, government bond markets in the United States and Canada rebounded in the fourth quarter as the weaker global growth outlook led investors to expect fewer rate hikes by central banks, leading to higher bond prices.

OPB’s Canadian office building portfolio, most notably in the downtown Toronto and Vancouver markets, received a significant valuation lift in 2018. This was offset by the uncertainty around the valuation of Canadian shopping malls in smaller urban markets generally, and the loss of income from the space left vacant by the closing of the Sears stores and the cost to reposition the former stores in our shopping centre portfolio.

In the area of private markets investments, OPB made two notable dispositions during the year. We sold our interest in Anglian Water for a $31 million profit – a 13.4% internal rate of return, including dividends received since its acquisition in late 2014. We also sold our interest in a high-growth branded consumer products company, a private equity investment, for a profit of $120 million – a 48% internal rate of return since it was acquired in December 2014.

How have we managed previous market downturns?

For defined benefit pension plans like the PSPP, we focus on long-term sustainability. We expect to see challenging market conditions and volatility from time to time. That’s why our long-term rate of return is the best driver of the health of the PSPP, which currently stands at a healthy 8.3% since inception. We’ve weathered negative conditions before, such as in 2008 when we had a return of negative 9.4%. However, our investment and funding management strategies helped us to recover from that experience, and will continue to do so, positioning us well to protect the pension promise for our current members and future members.

How has IMCO performed in its first full year?

One of the most important steps we took to enhance Plan sustainability was our strategic support for the creation of IMCO, an asset pooling and investment management vehicle, which launched in 2017. In IMCO’s first full calendar year in operation (2018), it hit several important milestones. These included hiring a Chief Investment Officer, a Chief Risk Officer, a Chief Economist, and a Senior Managing Director of Private Markets. These individuals have a wealth of professional investment management expertise and will play vital roles in IMCO’s future development and success; their choice to join IMCO is a powerful endorsement of the organization. For example, the mandate of the Chief Risk Officer is to strengthen IMCO’s risk management capabilities, systems and practices, and to oversee the design and implementation of IMCO’s critical enterprise and investment risk management functions while taking a comprehensive approach to risk monitoring and reporting.

Another key milestone was the approval by IMCO’s Board of its first Responsible Investing (RI) Policy, which incorporated a commitment to both the UN-supported Principles for Responsible Investment (PRI) as a foundation and to becoming a signatory to the PRI on April 1, 2019.

The IMCO Board also approved its first five-year business plan, which lays out an initiatives-based framework that will support IMCO in becoming a world-class investment manager by 2022/23.

How does OPB oversee IMCO?

IMCO allows participating clients like OPB to benefit from the greater opportunities for investment and partnerships as well as cost efficiency and economies of scale created through the sizable asset base it manages. Under this arrangement, it is essential to understand that OPB retains ownership of all of our assets, as well as the fiduciary obligation to ensure that the Plan’s assets are invested to protect the pension promise.

We meet that obligation in several ways. We start by outlining the overall investment strategy for our assets, setting our risk appetite and monitoring IMCO’s execution of our Strategic Asset Allocation (SAA) policy. Further, we participate in the development and approval of IMCO’s overarching investment policies and individual asset class investment strategies and charge IMCO with implementing these strategies to the benefit of its clients, including OPB.

We oversee how IMCO is performing through a formal continuous monitoring program and ongoing, open dialogue with IMCO executives. The monitoring program sets out a variety of key performance indicators (KPIs). The focus of these KPIs is captured in a phrase we use regularly: Clients First and Costs Matter. They allow us to assess IMCO’s investment performance, as well as its performance on other duties, and to ensure that it is fulfilling its contractual responsibilities and obligations to OPB.

Why are we shifting our focus from public to private markets?

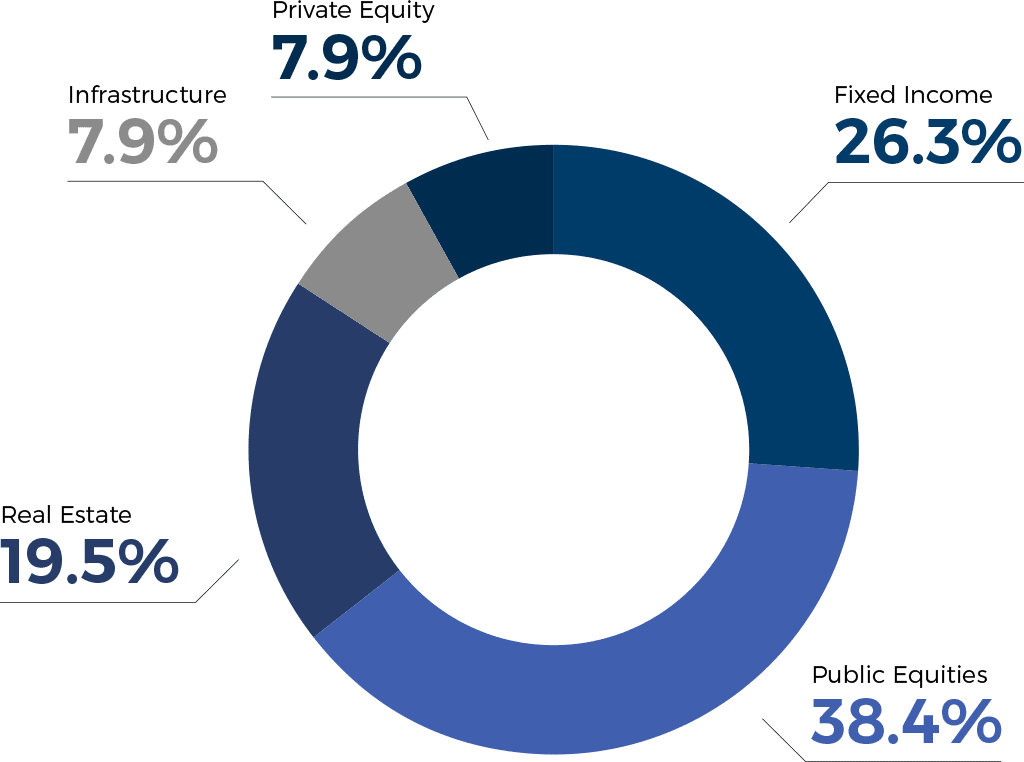

Over 2018, through the phase-in of our SAA, IMCO continued to implement the shift from public to private markets in our investment portfolio. Pursuant to our current SAA, the policy target is to have 41% of the Plan’s market value invested in private markets assets, including real estate, infrastructure and private portfolio companies.

Core real estate and infrastructure assets offer many benefits, including ongoing annual cash flow, through rentals and leases with creditworthy tenants, and inflation protection. Opportunistic investments in these two asset classes can generate increased investment returns. Across the board, private equity investments have the potential to provide returns above what can typically be achieved in the public equity markets.

However, the particular challenge with respect to private markets investing is that it requires time, subject expertise, dedicated people and deep research capabilities. All of this capacity will be better delivered through IMCO because it is purpose-built to supply it.