In 2020, we took steps to further incorporate Responsible Investing into our strategic approach, participated in IMCO’s first investment pool and successfully navigated the market volatility to earn a solid return.

Assets Under Management

$31 billion

Rates of Return

OPB’s one-year, five-year, 10-year and since-inception compounded annual rates of net investment return for the period ending December 31, 2020 are as follows:

| 1-year | 5-year | 10-year | Since 1990 | |

|---|---|---|---|---|

| Fund return | 7.0% | 7.2% | 7.3% | 8.1% |

| Benchmark return | 6.5% | 7.4% | 7.2% | 7.9% |

Note: Returns are net of all Plan administration and investment management expenses.

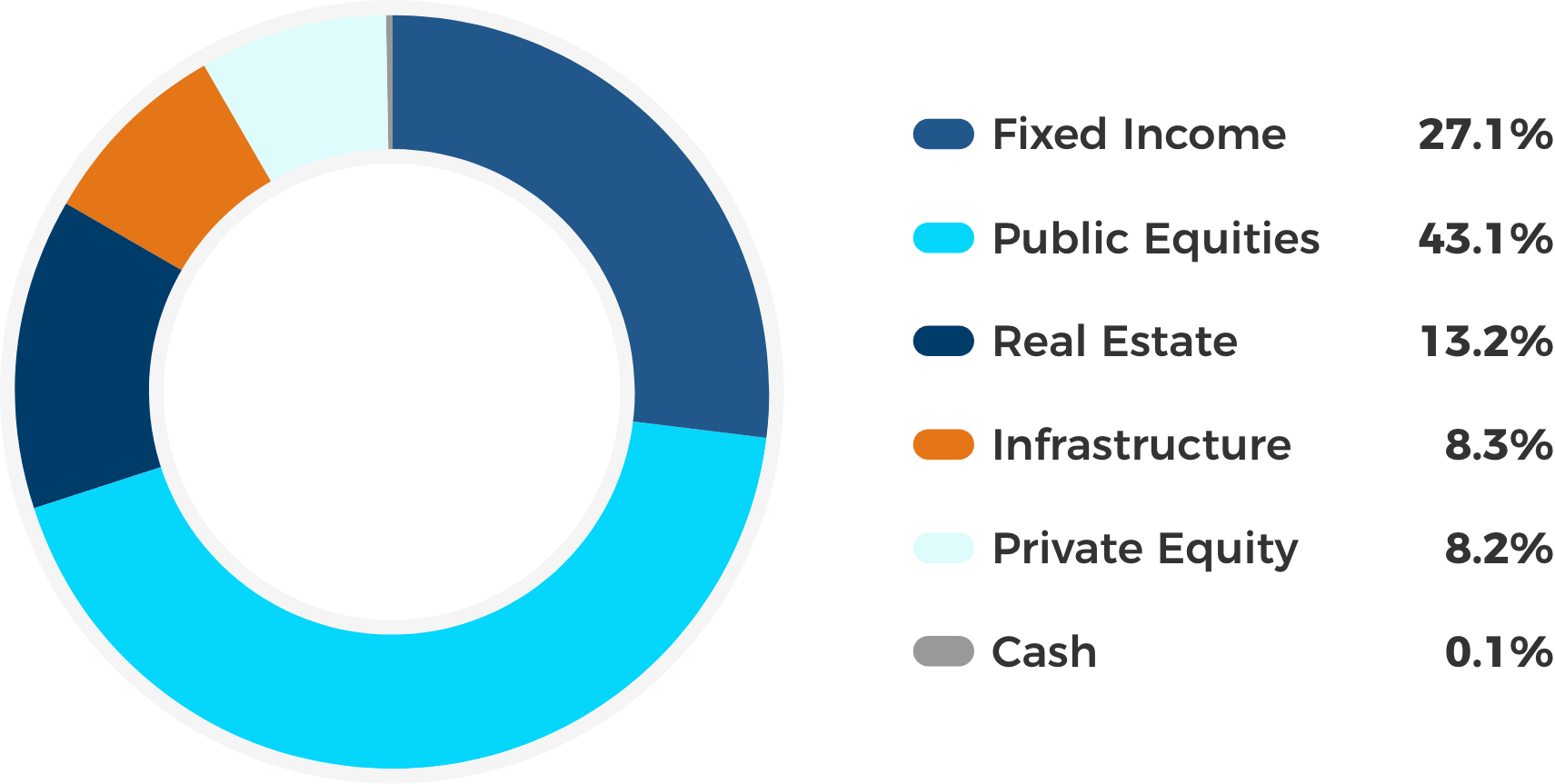

Asset Mix

Fixed Income: 27.1%; Public Equities: 43.1%; Real Estate: 13.2%; Infrastructure: 8.3%; Private Equity: 8.2%; Cash: 0.1%.